Dollar-Cost Averaging - your path for

Long-Term Financial Success!

DCA is a low risk investing strategy that helps reduce the impact of market volatility by spreading your investments over time, mitigating the risk of buying at unfavorable high points. It also encourages disciplined and consistent investing, fostering a long-term wealth-building mindset.

What is Dollar Cost Averaging (DCA)?

Your daily financial literacy strategy

The DCA (Dollar-Cost Averaging) is a crypto investment strategy that consists of efficient distribution and disciplined funds of fixed assets during a certain period of time.

If you choose DCA, then you do not need always to check price of asset. You use a system in which you accumulate investment volumes and thereby neutralize the potential impact of market impulses.

Practical Steps for Portfolio Growth

Even your Grandma could do it

01.

07.

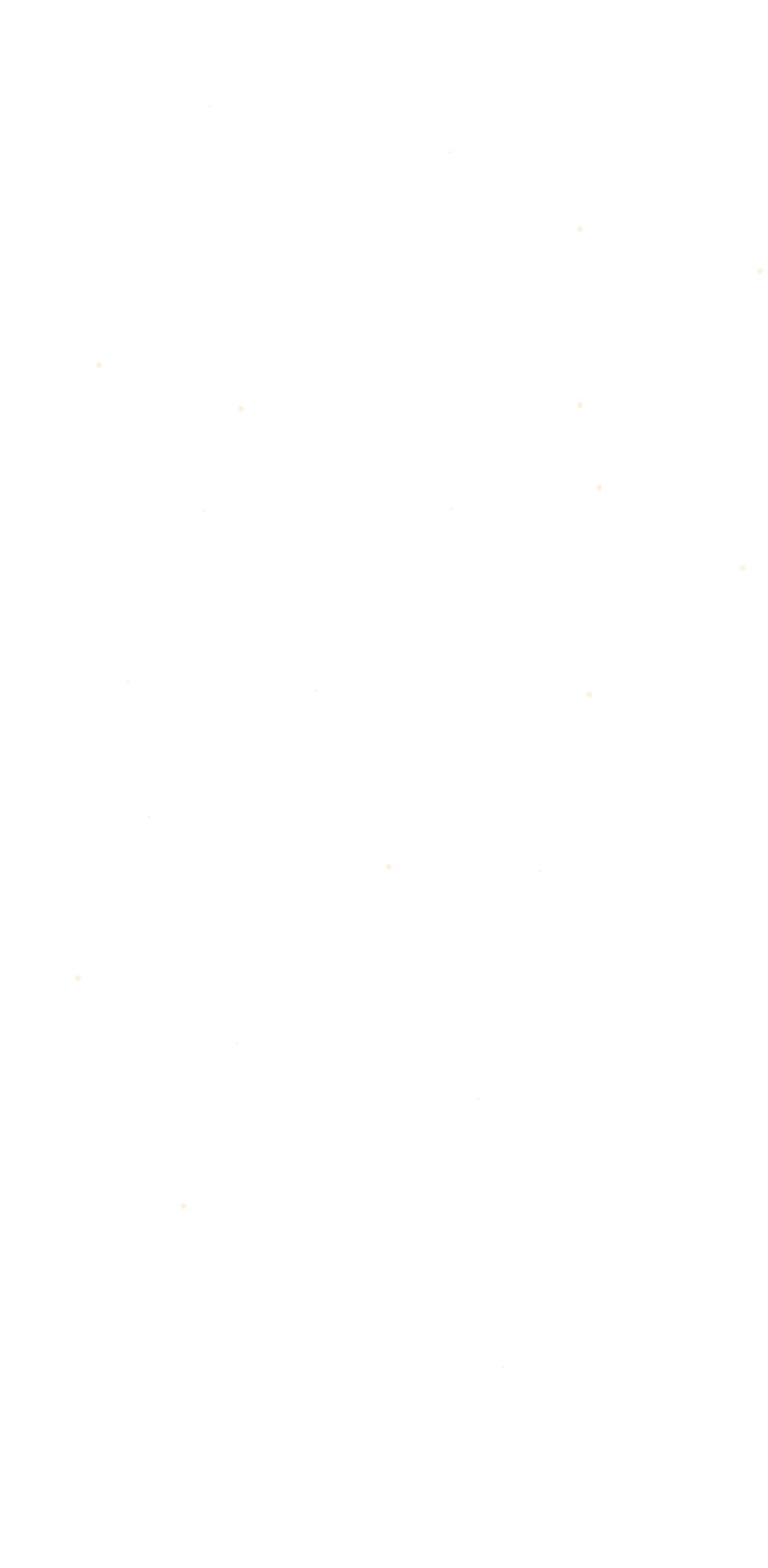

Calculate Earnings Possibilities

in

a DCA Approach

The application's unique mechanics will allow you to fully check out the rewards you can receive for your initial assets within a specific time frame. Enter key savings parameters into DCA to simulate potential returns.

How does DCA Strategy Work?

Small steps towards to prosperity

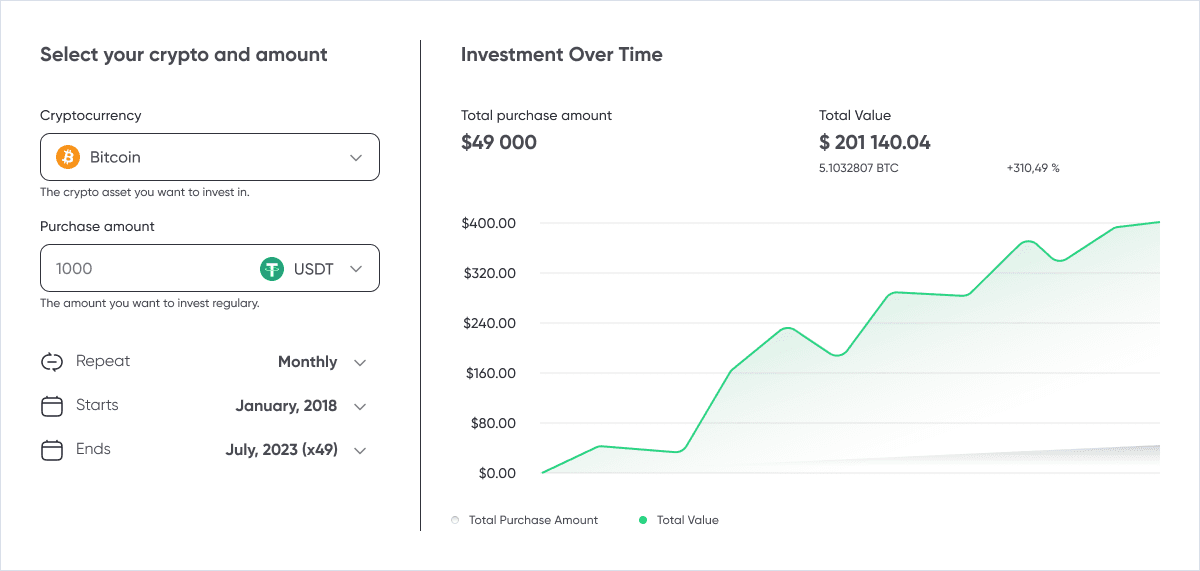

DCA's strategy is to invest in specific digital assets in a disciplined and accurate manner, according to a schedule you create, regardless of what happens in the market or asset.

Dollar-cost averaging crypto uses market volatility to increase cryptocurrency balance and generate profits over time. By accumulating more units during market downturns and capitalizing on price increases during market recovery, you increase the likelihood of increased cryptocurrency balances and potential profits.

swipe

$1000 at $10

purchases

each month

investing $100 monthly

Newbies

Non-DCA crypto portfolio

They doesn`t know investment strategies and he is a fan of quick profits and risks. They put all of his savings into high-risk assets and received -75% of his portfolio per year.

Experienced Investor

DCA crypto portfolio

Experienced investor understood all the dangers associated with one-time investments in a volatile market. They invested a set amount of money over the course of the year in low-risk assets using the DCA crypto strategy. They earned +55% for the year on her investments in a very volatile market as a result.

See how DCA can help you reach your financial goals by investing $50 weekly or monthly. Seize the DCA strategy advantage on SLEX.

Benefits of Dollar-Cost Averaging

Turn one time profit into a stable income

Invest With Low Risk

DCA crypto strategy reduces the risk of making wrong investing decisions. You regularly invest a fixed amount for a certain period and don`t pay attention to short-term market volatility.

Invest With Discipline

DCA helps you become disciplined and learn to invest according to a systematic plan. You invest a fixed amount at regular intervals, which allows them to stay on track.

Advantageous Entry Point

DCA offers a more seamless market entry due to the gradual spread of investments. You don`t make a sizable, one-time investment that is vulnerable to market volatility. You use a more comprehensive range of prices, and the average cost of entry is significantly lower.

Simplifying Investment Process

Consistently participate in the market thanks to DCA without having to make a sizable upfront investment because of regular contributions.

Investing With Low Expenses

DCA allows you to reduce costs by stretching the investment process over time. The longer your investment period, the more the end point of entry into the market decreases.

Emotionally Biased Investing

The DCA strategy helps you keep calm and reduces the risk of making impulsive decisions. Investors who automate their investments are less likely to be exposed to short-term market fluctuations or succumb to greed or fear.

- How to properly follow the DCA strategy?It all depends on you, your specific objectives, and your abilities. You can vary the intervals from a week to a month, depending on your short/medium/long-term goals. The most important thing to remember when using DCA is to be disciplined.It all depends on you, your specific objectives, and your abilities. You can vary the intervals from a week to a month, depending on your short/medium/long-term goals. The most important thing to remember when using DCA is to be disciplined.

- How reliable is DCA strategy?This method and HODL are regarded as the most effective long-term way of obtaining consistent returns. Simultaneously, as you implement DCA, you reduce potential risks because the length of the process reduces the final cost of your investments. At the same time, you must recognize that the market is not always a predictable environment.This method and HODL are regarded as the most effective long-term way of obtaining consistent returns. Simultaneously, as you implement DCA, you reduce potential risks because the length of the process reduces the final cost of your investments. At the same time, you must recognize that the market is not always a predictable environment.

- What assets to choose for DCA?DCA was developed to earn rewards from a systematic and disciplined stock investment. However, as time passes, the digital assets industry will be the most successful application of this tactic in 2023.

High volatility, massive hype, and constant fundamental news release propel the market to new heights. Because the crypto industry is still in its infancy, we can say that DCA effectively selects fundamentally sound assets.DCA was developed to earn rewards from a systematic and disciplined stock investment. However, as time passes, the digital assets industry will be the most successful application of this tactic in 2023. - Which investors are interested in DCA?This is a general strategy, so it can be interesting for new and experienced traders. It all boils down to its ease of use and efficiency and the low cost of time and resources.

This is an excellent way for a beginner to become acquainted with the digital assets industry and experiment with simple reward strategies.DCA can become a 6 months+ reward source by experienced players. DCA also appeals to market participants who are not looking for immediate gratification but for efficient and secure savings.This is a general strategy, so it can be interesting for new and experienced traders. It all boils down to its ease of use and efficiency and the low cost of time and resources. - Why is DCA so effective?The crucial feature of DCA is that it reduces the market's negative impact and risks of making emotional and irrational decisions. Simply being disciplined and adhering to your own deadlines will make DCA happy.

Using DCA also relieves you of emotional responsibility, the need to wait for the ideal moment to enter the market, and the problems connected to traders' impulse reactions. The main pros of this strategy are that users can decrease the average price of one asset by working diligently and methodically.The crucial feature of DCA is that it reduces the market's negative impact and risks of making emotional and irrational decisions. Simply being disciplined and adhering to your own deadlines will make DCA happy.

Join SLEX platform to trade on spot market

Initiate the DCA strategy with just $50-$100 and get your first long-term rewards.

No KYC up to 15,000 USD