HODL — long-term investment strategy

Stability and confidence in your portfolio even in the most volatile market. Explore the Cryptocurrency HODL Strategy on SLEX today and start trading with confidence!

What is HODL strategy?

Confidence and Calmness in each move on the crypto market

HODL is a long-term investment strategy when investors hold their assets regardless of short-term market volatility. Investors expect to profit from potential price increases over time. Investigate and choose cryptocurrencies with solid fundamentals and promising long-term prospects. HODLing is an excellent way to immerse yourself in the world of financial markets with little time commitment and potentially large rewards.

HODL strategy fits for

Novice Investors

The HODL crypto strategy is suitable for beginners because it is easy to execute. HODL does not require any special knowledge of trading, charting, and analysis of technical indicators.

Risk Averse Investors

These individuals prioritize capital preservation and are more cautious about taking on investment risks. They prefer more stable and low-risk investment options like HODL strategy or DCA.

Emotionally Stable Traders

This investor can maintain a calm and rational mindset even during market turbulence. They are less likely to be swayed by short-term market fluctuations and make impulsive decisions. They focus on long-term, low-risk strategies like HODL to maintain their emotional stability.

Passive Income-Oriented Investors

Passive Income-oriented investors seek regular income from their investments, prioritizing stable cash flows and small amount of work to do. Such investors use HODL, in conjunction with other types of earnings, as a strategy that will bring profit in the long term.

Opportunistic Investors

Some individuals actively seek investment opportunities and are ready to take advantage of every opportunity to earn. HODL can be a convenient way for this type of investor to make money through simplicity and potentially significant returns.

Case Study

If it were the beginning of 2023, you could profit from the HODL strategy. For example, you have 100 USDT and decided to use the HODL investment strategy. Let's find out what you can get!

Investment case 1.

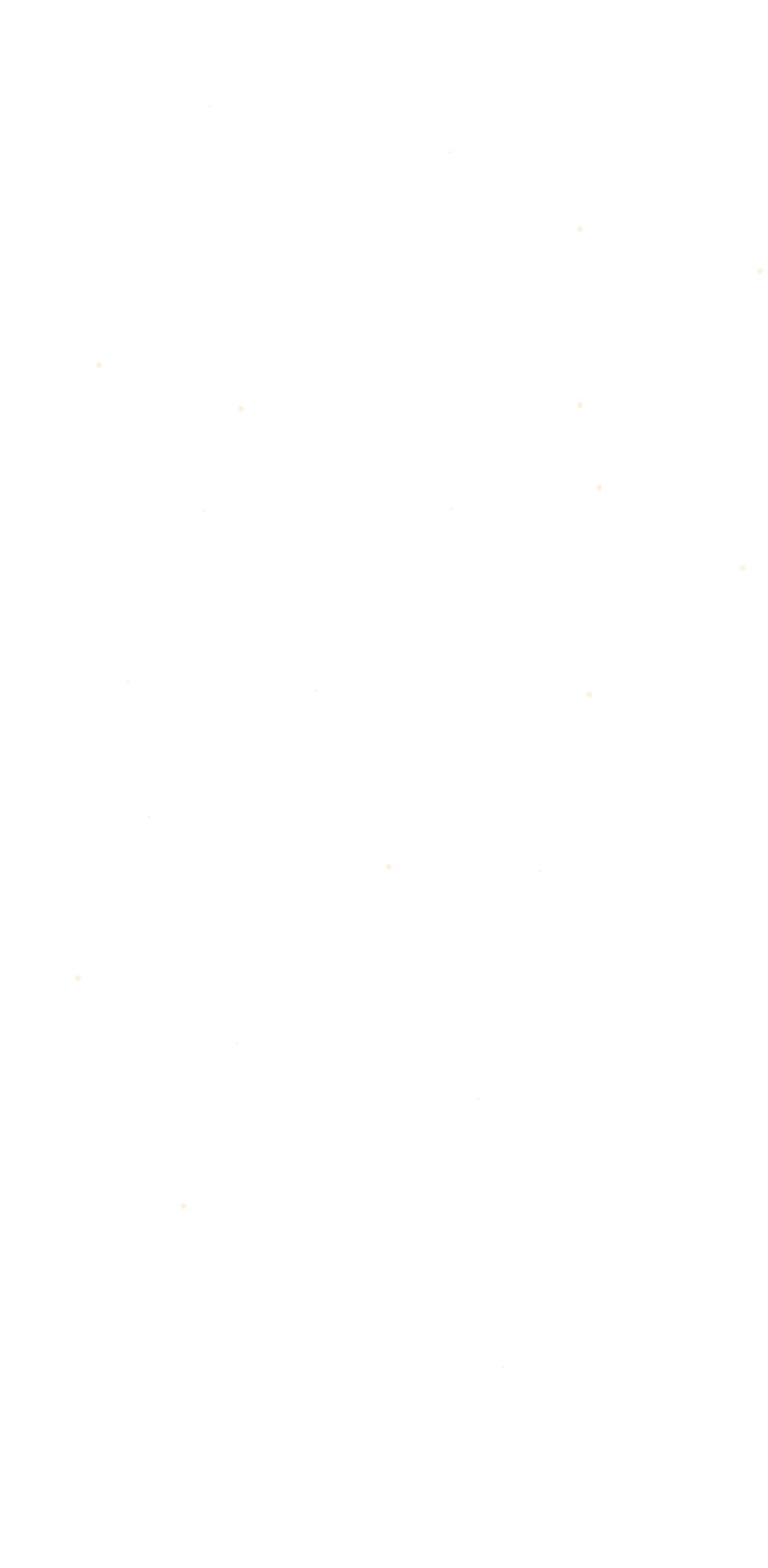

Let's consider a case where you want to profit from HODLing only one asset - Bitcoin.

1. You need to research and select an asset for HODLing - Bitcoin.

2. Next, you must buy $100 worth of Bitcoin and store it in your crypto wallet. Let's imagine that you bought Bitcoin in early January at $16,500.

3. HODLing your BTC assets till April of 2023.

4. Remember to check the market conditions and decide to take your rewards when Bitcoin gets to the local maximum.

5. Wow! You bought Bitcoin when it was $16k, now it is under $30k! Time to sell BTC at $30.5k to get your rewards from HODLing.

Results:

Earnings in USDT for 104 days of HODLing BTC

+$88.5

Earnings in % for 104 days of HODLing ВТС

+88.5%

Total wallet balance with initial investment of $100 in 104 days of HODLing BTC

+$188.5

Investment case 2.

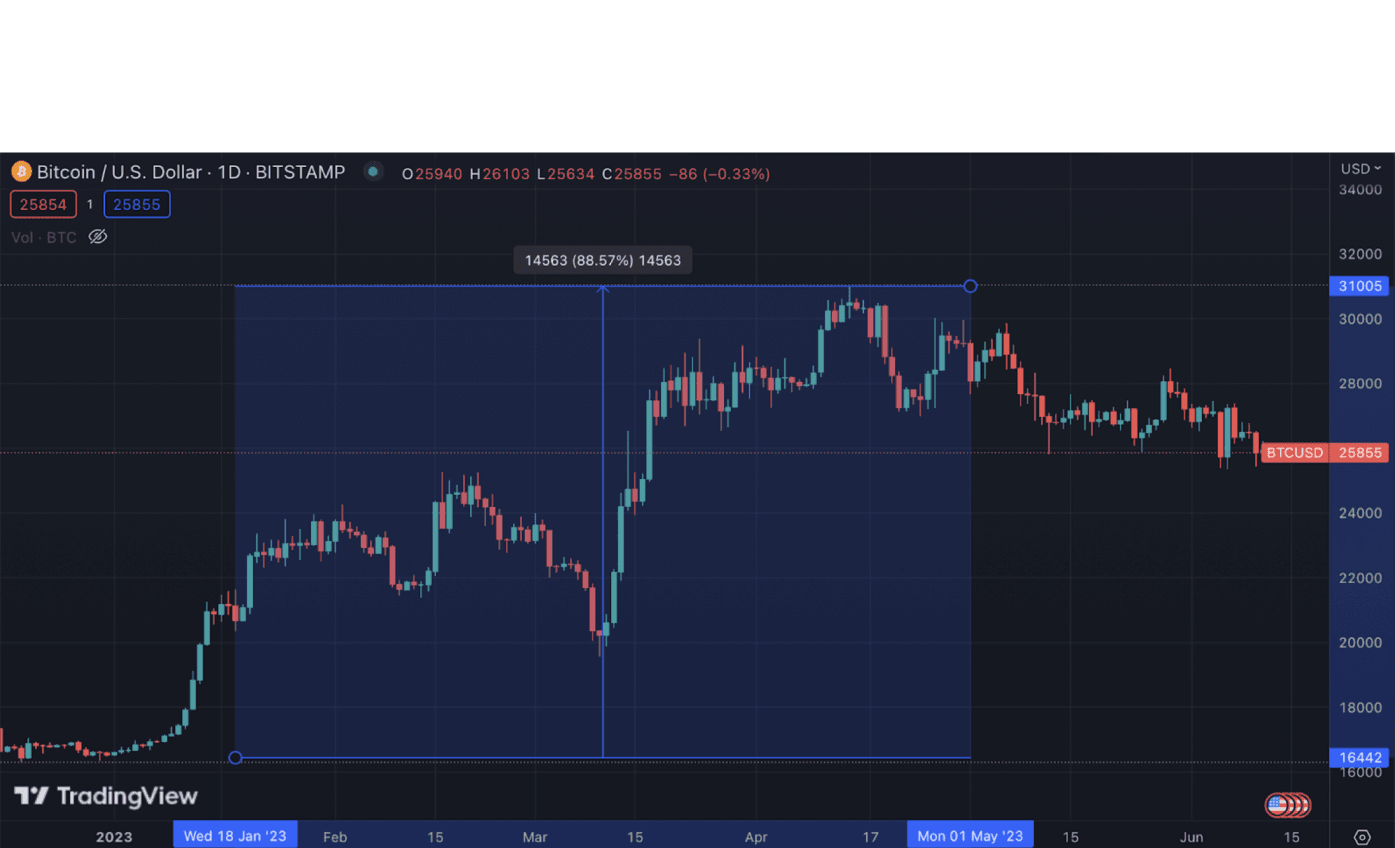

Let's consider a case where you want to profit from HODLing only one asset - Bitcoin.

1. First of all you need to do research and select assets for HODL - Bitcoin, Ethereum, Cardano, Solana, XRP.

2. You have only $100, so you can buy each asset only for $20 on January 1st at the following prices:

- BTC at $16,400;

- ETH at $1193;

- ADA at $0.2502;

- SOL at $9.91;

- XRP at $0.3375.

3. Great job! Now let's HODLing your assets till April of 2023.

4. Let’s check the market conditions and decide to get your rewards.

5. You think that assets are on the local top, so you decided to sell all assets on 14 of April when it costs:

- BTC at $30,500;

- ETH at $2102;

- ADA at $0.4390;

- SOL at $24.71;

- XRP at $0.52308.

Results:

Earnings in USDT for 104 days of HODLing BTC

+$88.5

Total wallet balance with initial investment of $100 in 104 days of HODLing BTC

+$188.5

Earnings in % for 104 days of HODLing crypto assets

BTC

+88.5%

ETH

+76.6%

ADA

+70.73%

SOL

+150.3%

XRP

+56.0%

HODL Strategy Key Benefits

Simplicity

Simplicity is one of the critical benefits of the HODL investment strategy. With HODL, you can avoid the constant time and effort required for active trading and chart analysis. Instead, you can track market price changes or set up price alerts to stay informed without continuous monitoring. This hands-off approach gives you the freedom to focus on other aspects of your life while still participating in the potential growth of your investments.

Long-Term & Significant Assets Growth

Experience long-term and significant growth of your assets with the HODL investment strategy. While the commodity market may show a slow and steady rise each year, crypto assets have the potential for explosive growth within a short period. Holding onto your investments allows them to capitalize on these rapid surges, maximizing your potential returns. This strategy will enable you to participate in the market`s overall growth while taking advantage of the unique and lucrative opportunities presented by the crypto industry.

Emotional Stability

By choosing a long-term HODL approach and avoiding frequent trading, you can avoid the emotional roller coaster of constantly monitoring market fluctuations and making impulsive decisions. Instead, you can have peace of mind knowing that your investments are positioned for long-term growth, allowing you to focus on other aspects of your life without the stress from active trading.

Lower Transaction Costs

Long-term hold involves passively storing funds without moving them between wallets or blockchains. Accordingly, HODLers can pay lower commissions than short-term traders during active trading.

Diversification

Investors can use the HODL strategy concerning several assets (diversification). The difference in investments in long-term storage will allow you to create a price barrier below which the total balance of the HODL portfolio will not fall if one of your assets is volatile.

Opportunity for Passive Income

You can get even more rewardsfrom the HODL strategy by staking or farming your crypto assets at favorable interest rates for a certain period.

HODL Strategy Main Consens

The Buy and Hold Long-Term Crypto Investment Strategy is a popular approach in which investors purchase cryptocurrencies and hold onto them for an extended period, typically years, with the expectation that their value will increase over time. Here`s a breakdown of this strategy:

Main Benefits:

Potential for Significant Returns

By holding onto cryptocurrencies for the long term, you can benefit from their potential to appreciate in value significantly. This strategy allows you to capitalize on the growth potential of the crypto market over time.

Simplicity and Ease

Buy and hold strategy is relatively simple to implement. Once you have purchased your chosen cryptocurrencies, you can store them in a secure wallet and monitor their progress periodically. This strategy does not require frequent trading or active management, making it suitable for investors seeking a more passive approach.

Diversification

Investing in a diversified portfolio of cryptocurrencies can help spread the risk. By holding a mix of different cryptocurrencies, you can mitigate the impact of potential losses from any individual investment.

Key Risks:

Market Volatility

Cryptocurrencies are known for their price volatility. The market can experience significant fluctuations, which may result in substantial gains or losses. Investors should be prepared for potential downturns and be willing to hold through market fluctuations.

Regulatory and Legal Risks

Regulatory changes or legal issues concerning cryptocurrencies can impact their value and overall market sentiment. It's essential to stay informed about the regulatory environment and potential risks associated with investing in cryptocurrencies.

Lack of Fundamental Analysis

Unlike traditional investments, cryptocurrencies may lack traditional fundamental analysis metrics, such as revenue, earnings, or cash flows. Valuing cryptocurrencies solely based on market sentiment and technical analysis may introduce additional risks.

How to Find Perfect HODLing Assets?

Simplicity and Ease

Buy and hold strategy is relatively simple to implement. Once you have purchased your chosen cryptocurrencies, you can store them in a secure wallet and monitor their progress periodically. This strategy does not require frequent trading or active management, making it suitable for investors seeking a more passive approach.

Balancing Act

Do not focus only on the crypto market. Look for valuable and profitable trading instruments in the commodity or stock markets. This will allow you to expand your potential profit, diversify your investment portfolio, and protect yourself from market fluctuations.

Strong Project Fundamentals

Look for assets that have the fundamental foundations of a successful crypto project, such as a large and active community, large partnerships, constant releases and valuable for market products.

Timing is Key

Enter the market strategically when assets are undervalued or experiencing temporary setbacks.

Trustworthy Partnerships

Select assets that are supported by reputable teams and well-established industry partnerships.

Exceptional Peculiarities of HODL Strategy

Bitcoin's Phenomenon

For early adopters, HODLing Bitcoin during significant price increases has proven to be extremely profitable. There are numerous examples of early Bitcoin investors becoming multimillionaires.

Strong Project Fundamentals

The term "HODL" was coined in 2013 as a misspelling of the word "hold" in a Bitcoin forum post. The title of the post, "I AM HODLING," expressed the author's intention to keep their Bitcoin investment despite market volatility. Since then, "HODL" has become an abbreviation for "Hold On for Dear Life."

Struggle with Views

HODLers believe that their philosophy is fundamentally opposed to short-term trading, which is perceived to be riskier and focused on quick results.

Join SLEX platform to trade on spot market

Initiate the HODL strategy with just $50-$100 and get your first long-term rewards.

No KYC up to 15,000 USD