Diversify Your Crypto

Portfolio to Get Long-Term Financial Success!

Ride the waves of the volatile crypto market on the SLEX platform. Use Cryptocurrency Diversification Strategy to trade with profit

What is Diversification in Crypto?

Confidence and Calmness in each move on the crypto market

A crypto diversification strategy weaves a tapestry of intelligently distributed digital assets like a creative kaleidoscope. Spreading cryptocurrency investments across a variety of tokens, coins, or blockchain projects is a clever way to balance risk and reward.

This approach aims to harness the potential growth of various cryptocurrencies while lowering the inherent volatility of the crypto sphere. A crypto diversification strategy is similar to an ecosystem that thrives on resilience, adaptability, and the promise of abundant returns because it spans a variety of digital assets with different characteristics.

Benefits of Crypto Portfolio Diversification

You can significantly lower both the long-term and short-term risks associated with the unpredictably volatile crypto market by employing a strategy to diversify your portfolio. By diversifying your investments, you can maintain the portfolio's overall value above a predetermined threshold and reap passive benefits from holding it over time.

I want to diversify my crypto portfolio. What will I get?

- Multi-Crypto funds

- Mitigated risk

- Adaptability to market changes

I will have a secure fund that brings me income.

Simple Guide to Creating

a Diverse Crypto Portfolio

Even your Grandma could do it

For Beginners

- Buy USDC with Bank Card on SLEX

- Check and Select the Diversification Strategy

- Pick the assets that you put into your portfolio

- Recommendation. Buy assets using DCA methodology

- Rebalance your portfolio periodically

For Pro Holders

- Review your current crypto portfolio

- Check and Select the Diversification Strategy

- Identify gaps in your portfolio

- Reallocate your investments

- Rebalance your portfolio periodically

Generate Diversified Portfolio

The Significance

of Diversifying

Your Crypto Assets

It's never too late to start

The importance of diversifying your crypto assets lies in the perfect balance of security and the ability to multiply your funds at the same time. In the ever-evolving world of digital currencies, diversification acts as a safe haven, protecting you from the vagaries of uncertainty and volatility.

By dispersing your investments across a mosaic of crypto assets, you reduce the risk of their depreciation. While one crypto project has a bad period, it is compensated by a positive wave of another cryptocurrency. A variety of digital assets protects your portfolio from the dangers of a scam or a significant drawdown of a single cryptocurrency or token.

In addition to risk management, diversification gives you a chance to earn substantial income from the growth of several digital assets at once. This is especially valuable in the crypto industry where there is a bear market and a bull market. You can expect significant rewards from all assets in your portfolio during a bull market. Crypto asset diversification is the path to sustainability, security, and long-term aspirations.

Benefits of Diversification Averaging

Turn one time profit into a stable income

Risk-Based

Diversification

The approach of Risk Avoiding Diversification serves as a wall against possible flops by distributing assets among additional digital currencies of various danger profiles. The underlying philosophy of this approach is to assemble a financial portfolio that harmonizes probable gains with user hazard tolerance. By employing RBD, investors can limit their vulnerability to a single digital asset and safeguard themselves from considerable losses.

Within the framework of Risk-Based Diversification, digital currencies are commonly classified into three tiers - high-risk, medium-risk, and low-risk, based on factors like fluctuation intensity, liquidity, market steadiness, and regulatory implications. Digital currencies with high-risk tags are usually linked to budding projects, smaller market valuations, and escalated volatility. Conversely, low-risk digital currencies are typically more solidified with more extensive market valuations, decreased volatility, and increased liquidity.

Sector-Based

Diversification

Sector-Based Diversification represents a tactical approach to investing, focusing on distributing investments across various cryptocurrency sectors. The strategy's principal objective is to decrease the concentration threat and seize prospective growth avenues across diverse segments of the crypto industry. By opting for Diversification among sectors, investors can leverage the unique dynamics and trends inherent to each sector, potentially boosting their portfolio's all-around performance.

The cryptocurrency market comprises numerous sectors, some of which encompass decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, infrastructure, privacy-focused digital coins, and corporate blockchain solutions. Each sector signifies a unique facet of innovation and has the potential to offer varying degrees of risk and growth opportunities.

Thematic

Diversification

Thematic Diversification constitutes an investment plan that centers on allocating funds to cryptocurrencies tethered to specific themes or concepts. This involves choosing cryptocurrencies that resonate with particular trends, notions, or burgeoning fields of interest in the digital currency market.

The objective of thematic Diversification is to construct a portfolio that mirrors an investor's principles, interests, and convictions while simultaneously seizing potential growth prospects in distinct thematic sectors. A few prevalent thematic sectors in the crypto market encompass decentralized finance, privacy and security, sustainability, social impact, gaming, the Internet of Things (IoT), and artificial intelligence (AI), among others.

Aggressive Crypto

Portfolio

The Assertive Diversification Strategy is a bold approach that centers on maximizing returns by distributing investments across riskier assets. This strategy usually attracts adventurous investors who are comfortable taking on a higher degree of risk in anticipation of potentially greater returns.

This aggressive stance involves considerable investment in growth-oriented, volatile assets, like small-cap stocks or high-risk cryptocurrencies, which, though they carry higher uncertainty, could yield substantial returns if they perform well. These volatile assets often present the potential for significant growth, albeit with the possibility of considerable losses.

Investors employing this aggressive strategy often have a longer investment horizon, enabling them to weather short-term market fluctuations. They're usually better equipped to withstand potential losses, being more tolerant of market volatility in their pursuit of higher returns.

Time-Horizon-Based

Diversification

Diversification with particular timing is a strategy revolving around picking cryptocurrencies based on your intended investment duration or the time you envision retaining your investments.

For short-lived investment periods, investors might concentrate on digital assets predicted to undergo notable price fluctuations or those with imminent events or triggers that could influence their value shortly.

In medium-term investment durations, investors could look into cryptocurrencies boasting robust fundamentals, continual development, and a promising growth outlook over a marginally extended timespan.

As for long-term investment horizons, investors might target cryptocurrencies grounded on solid bases, robust use cases, and sustainable growth prospects. It can be beneficial to prioritize established cryptocurrencies known for their stability and adoption, along with promising projects featuring disruptive technologies and future-oriented visions.

Long-term investors often strive to retain their investments across market cycles, capitalizing on the overarching growth of the crypto market over an extensive period.

Market Cap-Based

Diversification

Market Capitalization Diversification is an investment approach emphasizing dispersing investments amongst cryptocurrencies depending on their market capitalizations. Market capitalization is the overall worth of a cryptocurrency derived by multiplying its price with the total circulating supply of coins. It acts as a gauge of the cryptocurrency's magnitude, stability, and market growth prospects.

Big-cap digital assets, like Bitcoin and Ethereum, possess the most significant market capitalizations and are typically perceived as more mature and stable. These cryptocurrencies usually enjoy broader adoption, enhanced liquidity, and less volatility than their smaller-cap counterparts. Investing in big-cap digital assets can be a strong backbone for a diversified funds.

Mid-cap cryptocurrencies, including Cardano (ADA), Chainlink (LINK), or Polkadot (DOT), occupy the intermediate bracket of market capitalization. They present a harmony between stability and growth potential. Mid-cap coins may have exhibited promising technology, competent development teams, and escalating adoption, rendering them enticing options for portfolio diversification.

Small-cap crypto, such as Serum (SRM), Chiliz (CHZ), or Holo (HOT), bear market and are often synonymous with heightened danger and potential for substantial growth. These coins may embody nascent projects or pioneering technologies with the capacity to revolutionize industries, albeit with increased volatility and liquidity threats.

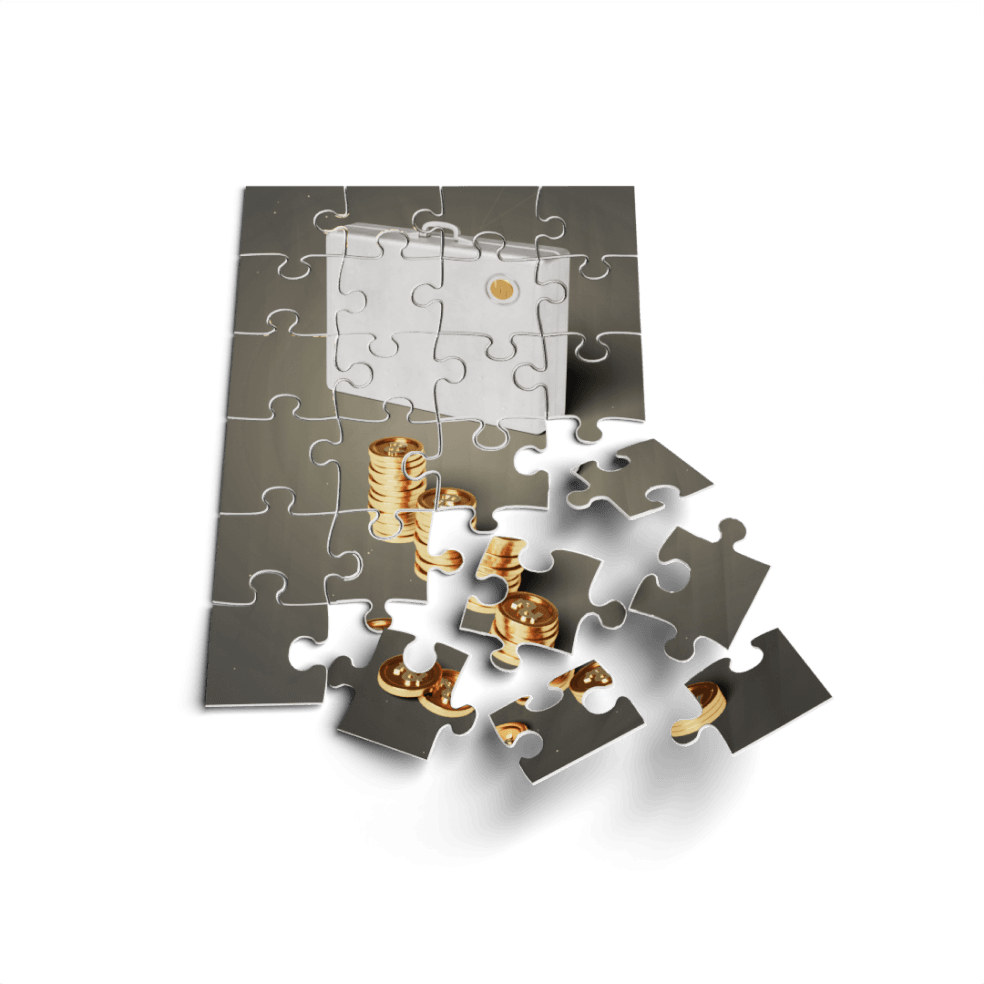

Newbie

Non-Diversified crypto portfolio

Bob did not know anything about the diversification of the crypto portfolio and decided to invest 100% of his assets in one cryptocurrency. Bob did not take into account the high volatility of the crypto market and the risks associated with the temporary downtrend of the asset in which he invested.

As a result, at the moment when he needed to use his funds, he received -53% to his investment portfolio.

Pro Traders

Diversified crypto portfolio

Pro traders responsibly approached investing in crypto assets. Pro traders understood that investing 100% of their funds in one asset is a severe risk. Therefore, Pro invested 40% in Bitcoin, 20% in Ethereum, 20% in stablecoins, and 10% each in XRP and BNB.

As a result, their total investment sank by at most 10% during the most challenging market period. And during the bull period, Pro traders received significant rewards from various assets due to diversification.

See how Diversification can help you reach your financial goals by reallocation of your crypto assets and reducing risk. Seize the Diversification strategy advantage on SLEX.

- Why is diversification important in crypto investing?Diversification in crypto investing is crucial as it helps spread the risk across different assets, reducing the impact of volatility and potential losses. By investing in a variety of cryptocurrencies, you can potentially capture gains from different market trends and balance the overall performance of your portfolio.

- How many different cryptocurrencies should I include in my diversified portfolio?The number of cryptocurrencies to include in a diversified portfolio depends on various factors, such as risk tolerance and investment goals. However, it is generally recommended to have a mix of different cryptocurrencies to achieve adequate diversification. A well-diversified portfolio may include a combination of established cryptocurrencies with solid track records, promising up-and-coming projects, and stablecoins for risk mitigation.

- Should I only focus on the top cryptocurrencies for diversification?While including some of the top cryptocurrencies in your portfolio can provide stability, it is not advisable to solely focus on them. Diversification entails investing in a range of cryptocurrencies with different market caps, sectors, and growth potentials. Exploring opportunities beyond the top cryptocurrencies can expose you to emerging trends and potentially high-growth assets.

- Is diversification only limited to cryptocurrencies?No, diversification extends beyond cryptocurrencies. It is recommended to diversify across different asset classes, including stocks, bonds, and commodities, alongside cryptocurrencies. This multi-asset diversification helps spread the risk further and can provide a balanced investment approach.

- How often should I review and rebalance my diversified crypto portfolio?Regularly reviewing and rebalancing your diversified crypto portfolio is essential to ensure it aligns with your investment goals and market conditions. The frequency of reviews and rebalancing may vary depending on market volatility and personal preferences. Some investors opt for quarterly or annual reviews, while others make adjustments based on significant market events or changes in their investment strategies. Ultimately, it's important to monitor your portfolio and make necessary adjustments to maintain diversification and optimize performance

Join SLEX platform to trade on spot market

Initiate the Diversification strategy with just $50-$100 and get your first long-term rewards.

No KYC up to 15,000 USD